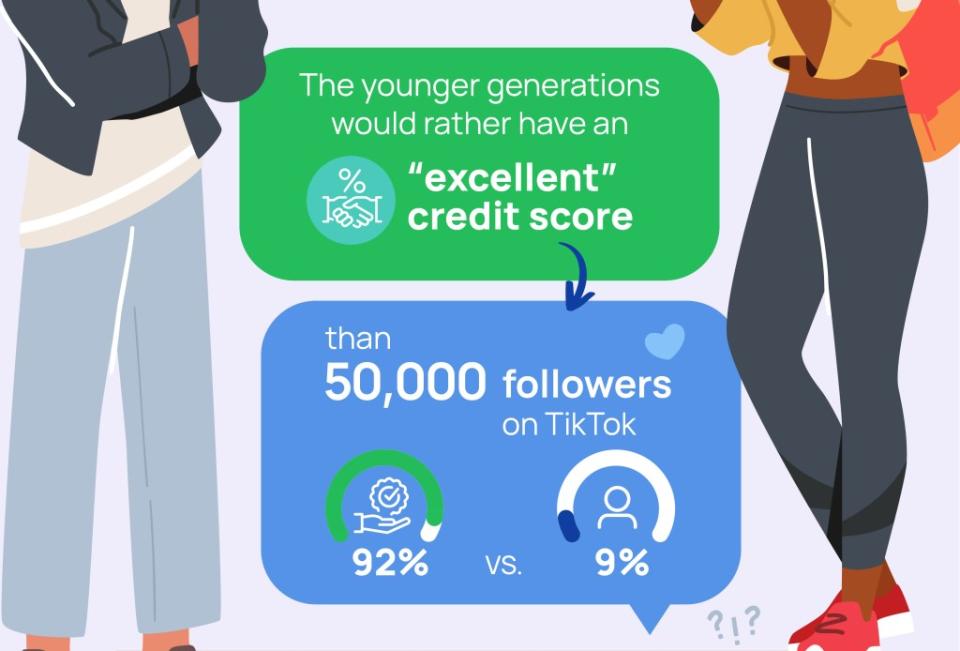

While TikTok continues to make its mark on the younger generations, healthy credit is still at the top of their minds.

A survey of 500 Gen Z and 500 millennials revealed that nine in 10 millennials would rather have an “excellent” credit score than 50,000 followers on TikTok, according to new research.

Even the internet-enamored Gen Zers would prefer a credit score of 750 or higher than thousands of followers on social media (92% vs 8%).

While TikTok continues to make its mark on the younger generations, healthy credit is still at the top of their minds, according to a new research. Tatyana – stock.adobe.com

Results also revealed that while 68% pay their bills mobily, more than half (54%) of respondents have only ever interacted with their credit card or credit score on their smartphone.

Conducted by OnePoll on behalf of Credit Sesame, the survey showed that some Americans may be late to the credit game — the average respondent only started building credit at 22.

Millennials tend to fall in line with kicking off their credit in their early twenties, as the average millennial opened a bank account at age 21, as well as got their first credit card and started to pay rent around the age of 23.

Gen Zers, however, opened their first bank account at 19 and both started to pay rent and got their first credit card at 20. Even so, one in 10 (10%) of Gen Z don’t have a credit card or credit score.

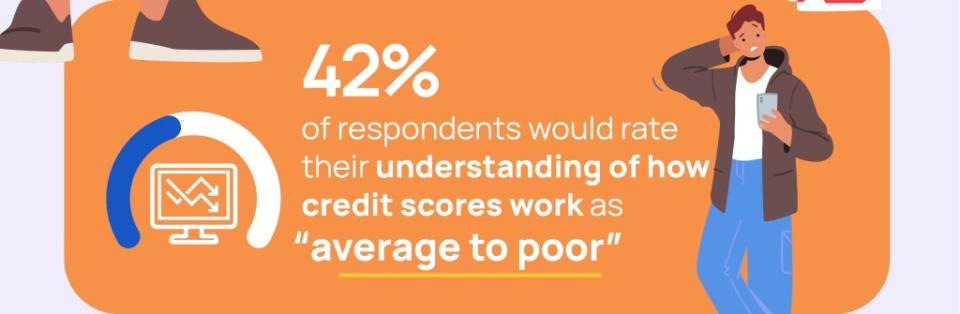

The survey also discovered that this late start to financial education may be responsible for Americans’ knowledge gaps.

A survey of Gen Z and millennials revealed that nine in 10 millennials would rather have an “excellent” credit score than 50,000 followers on TikTok. Credit Sesame

42% of respondents would rate their understanding of how credit scores work average to poor and more than two in five (44%) thought Americans’ average credit score was below 650.

Additionally, one-third believe that age-old myth that checking your credit score will affect it and 19% couldn’t correctly match the definitions of debit and credit.

And interestingly, 65% of respondents feel completely in control of their credit score.

The survey also discovered that this late start to financial education may be responsible for Americans’ knowledge gaps. Credit Sesame

“What we found through this survey is that while young people are often misperceived financially, they overwhelmingly understand that having good credit is the key to financial wellness,” said Adrian Nazari, Founder and Chief Executive Officer of Credit Sesame. “With 42% of respondents admitting they have a poor understanding of how credit scores work, we have a huge opportunity to educate and empower the younger generations.”

Overall, 43% of respondents prefer to bank online and 28% admit they either “always” or “often” feel judged for banking in person.

Similarly, 28% of Gen Zers “always” or “often” feel judged when using cash to pay, with almost a third of millennials sharing the same sentiment (31%).

“With 42% of respondents admitting they have a poor understanding of how credit scores work, we have a huge opportunity to educate and empower the younger generations,” said Adrian Nazari, Founder and Chief Executive Officer of Credit Sesame. Credit Sesame

And it isn’t just how they pay, 82% of respondents admit they struggle to keep up with their friends’ saving and spending habits.

This was especially true for millennials, as 69% either struggle “very much” or “somewhat.” For Gen Z, only 24% fall into the “very much” category, while more (40%) tend to “somewhat” struggle.

In light of the current economy, respondents tend to be more risk-averse than riskier with their spending (48% vs 31%) while 27% actually believe obtaining access to credit in 2024 will be somewhat easier.

one in 10 (10%) of Gen Z don’t have a credit card or credit score, according to the survey. Credit Sesame

This may be due to the fact that increased digital banking (24%) and as well as increased awareness and access to credit scores (20%) have changed Americans’ approaches to spending the most.

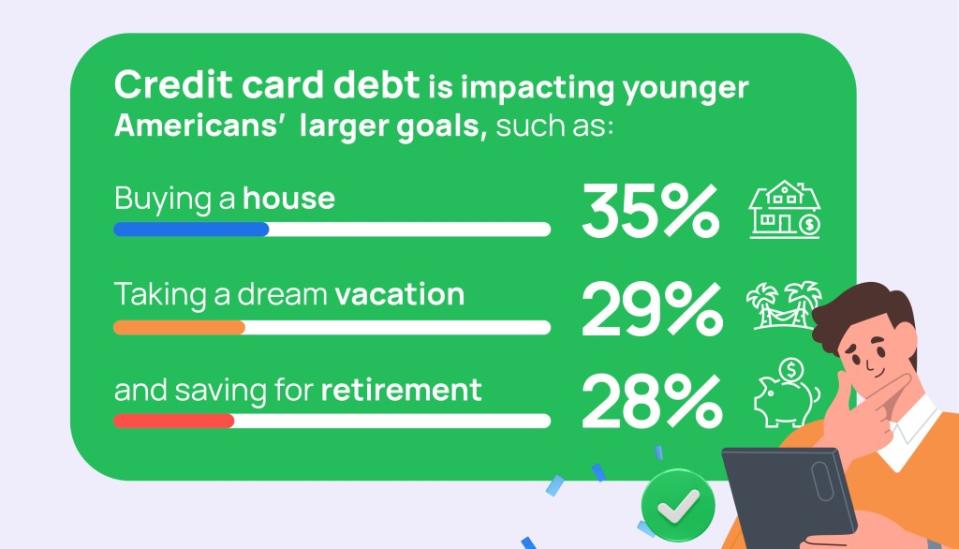

Credit card debt also impacts Americans’ larger goals, such as buying a house (35%), taking a dream vacation (29%) and saving for retirement (28%).

But when it comes to overall financial practices, respondents abide by “time is money” (52%), “save for a rainy day” (46%) and “never spend money before you have it” (42%).

Credit card debt also impacts Americans’ larger goals, such as buying a house, taking a dream vacation, and saving for retirement. Credit Sesame

“While it’s admirable that the younger generations care deeply about social issues, it’s not all they care about,” said Nazari. “They care about building and maintaining a positive credit history, so that they can achieve greater financial independence.”

Survey methodology:

This random double-opt-in survey of 500 Gen Z and 500 millennials was commissioned by Credit Sesame between Dec. 22 and Dec. 28, 2023. It was conducted by market research company OnePoll, whose team members are members of the Market Research Society and have corporate membership to the American Association for Public Opinion Research (AAPOR) and the European Society for Opinion and Marketing Research (ESOMAR).